Small Company – Simple Tips To Determine Loan Covenants. What you ought to Learn About A Negative Loan Covenant

As soon as your business relates for a financial loan, also it’s approved, the mortgage contract will likely include loan or restrictive covenants. It is just a declaration between loan provider and debtor stating that the business that is small can can’t do particular things while you’re having to pay from the mortgage.

In the event that bank considers your company risky, you’ll likely have significantly more restrictive covenants. Reduced danger businesses could have less. Banking institutions determine danger on a few facets, such as for example:

What you should Realize About A Negative Loan Covenant

Often, loan providers elect to produce a firewall around major ownership and economic choices produced by you, the business owner that is small. To work on this, they promise the rights are owned by them to notifications such as for example alterations of money framework.

In change, this streamlines your credibility and reduces your odds of defaulting. That’s why it is essential you understand the terms of the loan covenants to ensure you aren’t caught up in any unintentional cross-fires as lenders will do what they can to hang on to their investment for you to make sure.

What you should Learn About an loan that is affirmative

As opposed to loan that is negative, affirmative covenants remind borrowers that they have to perform particular tasks to keep up healthier company operations. In change, this produces a well balanced economic return.

Should you breach this covenant, you’ll take standard of the responsibilities in addition to loan provider might impose a elegance duration for which to repair the violations. The worst situation is the fact that the lending company may announce it being a standard and need complete payment.

Typical affirmative loan covenants include:

You consent to keep risk insurances such as for example basic and home obligation

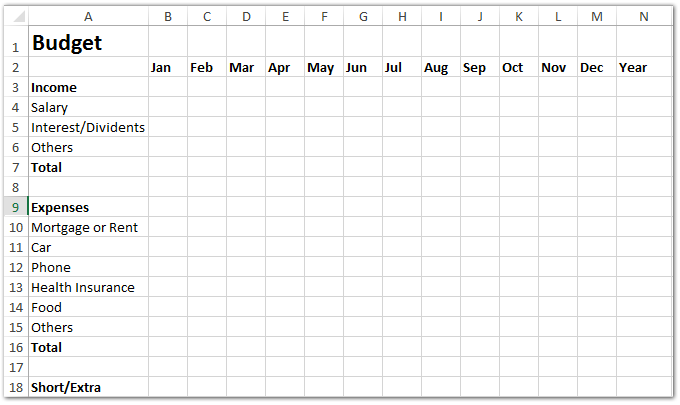

Your organization must submit regular monetary statements to the lender

You consent to keep “key man” life insurance policies on management

The company must submit accounts receivable and payable reports monthly

You have to submit annual tax that is corporate

All state charges and taxes become compensated and held around date

You need to submit yearly individual tax statements of individual guarantors

All shareholder loans should be subordinate to your financial loan

On bigger loans, the lender may need an assessment or review regarding the annual monetary statements

You consent to keep performance and liquidity ratios

Covenants Can Protect Your Enterprise

Supplied you have got an understanding that is thorough of covenants, they could protect your organization. Regarding the entire, covenants protect your earning assets.

Loan covenants either require you are doing one thing or prohibit you against doing one thing. Another two typical forms of loan covenants are qualitative and quantitative.

With a loan that is quantitative, you may need to carry on with a specific debt-to-worth ratio because set out by the lender. Instead, you might not surpass a specific debt-to-worth ratio. Additionally, with this particular style of covenant, you might be necessary to keep a ratio that is certain of to total assets.

Having a qualitative loan covenant, you may need to offer monetary statements within 10 times of the close of each and every quarter. Or, may very well not incur any debt that is further other loan providers with no bank’s prior contract.

Loan covenants promise you don’t sell off your gear, as an example, you’ll want to offer your solution or create your items. Covenants are geared towards keeping you away from difficulty along with your company afloat.

Negotiating Loan Covenants along with your Lender

The economically more powerful your business that is small is the higher the position you’re directly into negotiate your bank’s loan covenants. Banks utilize the loan covenants to limit dangers and protect their passions. They’re perhaps perhaps not likely to make that loan to your small business when they don’t desire you to achieve success, this means there’s more often than not space for settlement.

You’ll need complete economic statements and a well-thought-out company plan should you want to negotiate. But, you’ll also require an intensive comprehension of loan covenants, which is the reason why its smart to possess  a qualified attorney on side.

a qualified attorney on side.

Book a session at Principal attorney for assistance with your loan covenants and negotiations today.

Comments are closed.